How do find our next big business idea? Identifying problems and pain points is a great way to start. Discover methods for generating ideas and learn practical ways to test your ideas here.

How do you identify a viable new business idea? How can you tell if your idea will lead to a profitable business? Learn tested methods for idea generation and discover how to test your ideas in efficient ways.

How do find our next big business idea? Identifying problems and pain points is a great way to start. Discover methods for generating ideas and learn practical ways to test your ideas here.

Founders provide the heart and soul of most startups but learning how to effectively lead and manage a growing team can be challenging. Learn strategies for adapting from inspirational leaders.

Forgoing a written founders’ agreement ranks within the top ten legal mistakes that plague founders as their companies grow. When should you create a formal legal agreement with your co-founder(s)? What terms should it include? Learn what questions to ask before you draft and sign an agreement.

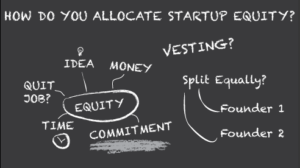

Deciding how to allocate equity can be one of the leading sources of founder conflict. As startups mature, the percentage of founders who express unhappiness with their equity split increases by 2.5x. Learn the most common mistakes founders make when dividing equity and get tips on how you can avoid them.

Many entrepreneurs conflate raising money with building a successful startup. But getting a high valuation or landing a VC firm isn't a strategy or validation of your business plan. Who you raise from—and when you raise—matters as much as how much you raise. HBS faculty and entrepreneurs share applicable frameworks and tactics to help you approach various aspects of fundraising--from pitching to navigating a term sheet--strategically, with your business model in mind.

Research indicates that in recent years, less than one percent of startups raised venture capital. In a series of short focused interviews with Shikhar Ghosh, entrepreneurs and investors share relevant experience-based tips about what VCs need to see to offer a term sheet. Investors offer takeaways about how they weigh a startup's business model, team composition, clarity of thought, and attitude towards risk that can help entrepreneurs understand what VCs need to see in order to invest. Founders who have raised funding share their insights on timing, iterating your pitch, learning from no, selecting appropriate VCs.

How do you assess and navigate a term sheet, making sure you’re getting the best payoff for your company? Gaining a better understanding of terms and their long term consequences can help you avoid mistakes entrepreneurs commonly make.